Service and repair

Local services for your success

We are here to help you – Alfa Laval is your partner in overcoming the toughest plant and service challenges and optimizing processes that enhance sustainability and profitability. Our service teams ensure your plant or process is up and running. Whether it’s providing phone or online consultation, repair and reconditioning at one of Alfa Laval’s service center locations or servicing and repairing equipment at your site, we are engaged and committed to exceeding your expectations. What you need, when you need it, with Alfa Laval service quality.

The services and solutions in our Alfa Laval 360° Service Portfolio help you get the best return on your equipment investment – throughout its life cycle. We partner with you in every aspect, from spare parts, maintenance and support to improvements and monitoring services over time.

Looking for a specific service?

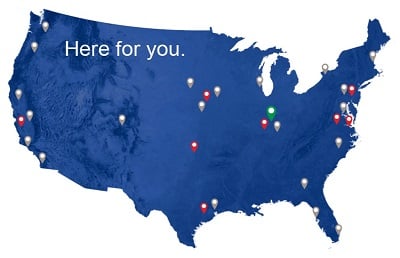

Expert support wherever you are

Click the map to find your local service center.

Locations

Des Moines, IA

Decanters | Plate heat exchangers

Ankeny, IA 50021

Chesapeake, VA

High-speed separators | Decanters

Chesapeake, VA 23323

Fresno, CA

High-speed separators | Decanters |

Plate heat exchangers

Fresno, CA 93725

Greenwood, IN

High-speed separators | Decanters |

Plate heat exchangers

Greenwood, IN 46143

Houston, TX

Plate and welded heat exchangers |

Decanters | Belt presses

Houston, TX 77038

Richmond, VA

Plate heat exchangers

Richmond, VA 23231

New York, NY

Plate heat exchangers

New York, NY 10036

Phone: 1-551-229-8651

Broken Arrow, OK

Air Cooled Exchangers

Broken Arrow, OK 74012

Phone: +1 918-251-7477

Coatesville, PA

Tank cleaning equipment

Coatesville, PA 19320

Phone: +1 610-408-9940

Newburyport, MA

Contherm Product Center

Newburyport, MA 01950

Phone: +1 978-465-5777

Tonawanda, NY

Wet Surface Air Coolers |

Dehumidification systems

Tonawanda, NY 14150

Phone: +1 716-875-2000

Our team, your support

– a click or call away

Alfa Laval provides local repair service and technical support for a complete range of heat transfer, separation and fluid handling products. Call our customer service hotline or fill out the form and we'll connect you to a service expert right away – even if you need Alfa Laval service or support after hours.

Contact us

Hotline: 866-253-2528 (866-ALFA-LAVAL)

Sanitary pumps, valves, heat exchangers and fittings: 800-558-4060

Alfa Laval service centers specialize in:

Preventive maintenance

Prevent problems before they occur

Preventive maintenance and repair reduce unplanned stops, spare parts stock and workplace accidents, increases equipment lifetime and enables you to make the best use of resources.

Preventive maintenance is performed as a stand-alone service, when your equipment has been in operation for a certain number of hours, and at a fixed interval to avoid unplanned stops. It can also be part of a Service Agreement.

Calibration

Specially trained Alfa Laval repair experts at your service

To keep your equipment performing at the required level and to maintain a safe operation, accuracy is vital. Our experts are specially trained to perform calibration on specific equipment on site or at an Alfa Laval service center. It’s a good way to document certification to meet legal requirements and optimize performance.

Spare parts

Boost productivity and maximize uptime with quality genuine parts from Alfa Laval. With easy access to an extensive range of long-lasting high-quality parts, you can lower your total cost of ownership and preserve the value of your equipment throughout its entire life cycle. Manufactured with OEM knowledge and precise specifications, Alfa Laval spare parts have proven performance in our material and test laboratories, as well as in process lines around the world.

Training

Alfa Laval training is designed to reduce operating costs, raise your team's competence and safety, expand their skill sets and stimulate and motivate them to get optimum performance from your systems and equipment. Let us help you increase production efficiency, conserve energy and minimize environmental impact.

Field service

Alfa Laval's field service engineers are fully equipped with the tools, parts and expertise to repair and recondition your equipment, no matter the manufacturer. You can count on our highly qualified Alfa Laval repair technician to conduct an online assessment and work with your team to quickly restore and improve the performance of your equipment.

Repair

Maximize your production performance and avoid consequential damage and accidents, by letting the expert who built the equipment, repair it. Alfa Laval service locations are modern facilities and are strategically located close to you. We provide repair and support services that prolong your equipment's service life and keep it up and running.

Reconditioning

Reconditioning services can enhance the performance of your equipment, extend its lifetime and ensure a safe and efficient operation. Crack detection, reassembling and pressure testing are just some of the things we help you with, as well as making recommendations for other service or repair measures. You can tailor your own package of services or choose a pre-defined one.

Cleaning

Keeping your equipment clean lowers maintenance and operating costs and extends your equipment’s lifetime. Alfa Laval offers a range of Cleaning-In-Place (CIP) systems and non-toxic chemical cleaning agents, specially designed and formulated to remove deposit build-up effectively from heat transfer, separation and freshwater generator equipment. The Houston service center has an ultra-sonic wash that cleans heat exchangers and decanters in less time.

Case stories

Hear from real Alfa Laval customers and their experience when partnering with us for service and support. Whether as needed or through a service agreement, our customers have benefited from pursuing services like spare parts, reconditioning and more.

Webinars

View our live and on demand service and support webinars and learn everything from basic to ways to reduce maintenance costs and increase uptime on our full range of heat transfer, separation and fluid handling products.